Table of Contents

Why Personal Finance planning is important?

Like every generation, wealth is created in this century as well. Rather too much of it. But the younger generation, millennials, have an important distraction with respect to availability of avenues where they can spend that wealth.

This generational shift towards spending the more money towards “wants” instead of “needs” is the reason, understanding personal finance and its planning is important in today’s world.

It is not necessary that only the younger generation who is distracted towards “wants”. In this world of technology and advertisements, each and every person irrespective of age, gender gets targeted by companies and end up spending money on the things which could have easily avoided.

What is Personal Finance?

“Money, like emotions, is something you must control to keep your life on the right track.”

Natasha Munson

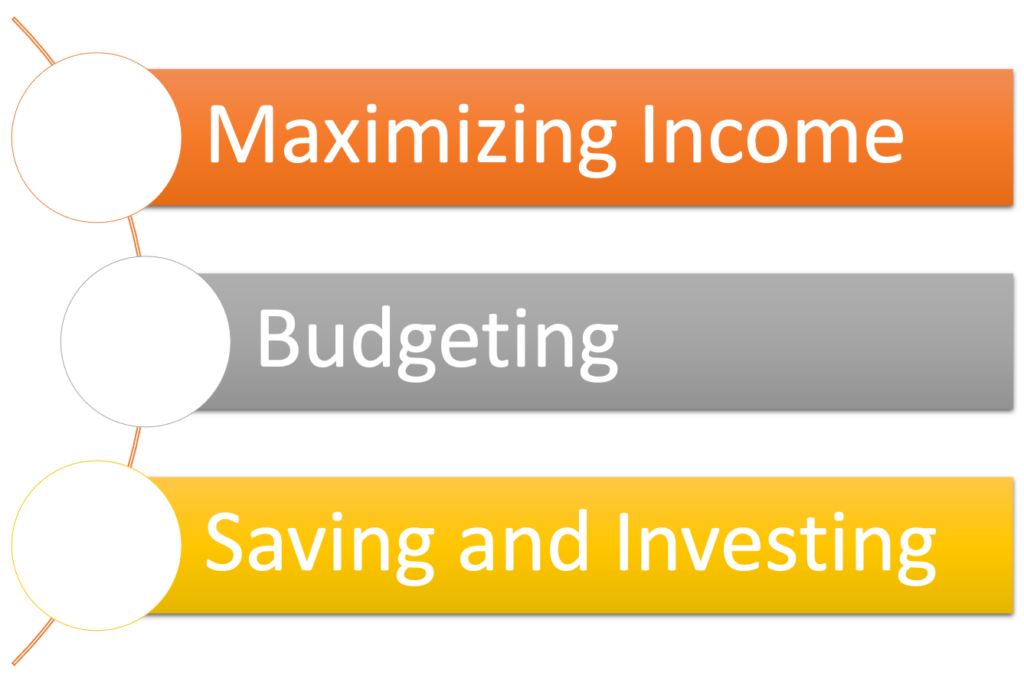

Simply put, Personal Finance is taking care of your money effectively. Maximizing your earnings (Income) , keeping track of your expenses (budget) and smartly putting money towards avenues which will help you achieve your future goals (save & invest) are the basic pillars of Personal Finance.

How you approach these three pillars defers person to person. The personal finance rules for student may not be same as those for young adults. And the personal finance rules for young adults may not be same for say a person in his 40s or 50s. Likewise it will be different for single vs married, low income vs high income, families with vs without kids, nuclear vs joint families etc.

But the basic principles of Personal finance will remain same which can be applied by anyone.

In this blog I will be discussing on those basic principals which will help you become financial savvy and take control of your finances.

Three main pillars of Personal Finance

As discussed earlier, there are 3 main pillars on which any personal finance depends on. We will go in each of then in little bit but before that understand one thing – unless you give importance to each of these 3 pillars you are bound to fail in your finances. So make sure you learn about each of these steps and implement those in your finance planning.

Let’s begin !

(1) Income – Maximize your earnings

If you look around you will understand that things are not same as those were 15-20 years ago and will not remain same after 10-15 years. Every passing day life changes so when you can, you should maximize your earning for any rainy days or bright futures alike.

There are many ways to increase your earnings. Starting early career, getting the pay hike, working on a side hustle, passive income sources etc are some of the ways you can maximize your income.

We will discuss this in details along with some valuable tips in future blogs.

Also read : 5 Best Ways To Maximize Your Income

(2) Budget – Plan your expenses

Budgets are not just related to organizations or countries. Budgets are equally important in each individual’s financial planning. Unless you create a budget or plan your expenses it is very likely that you will end up spending towards your “wants” instead of “needs”. This will result in collapsed finances which will severely impact your savings and ultimately your financial goals.

Budgets are custom made to suit each person’s financial goals and equally depend upon income he s generating. But there are some basic rules like rule of 50/30/20 which you can follow to get started.

We will discuss more on Budgeting and its different aspects along with some useful tips in future blogs.

Also read : Effective Personal Finance Budget To Save Your Money

(3) Save & Invest – work towards your future goals

Saving and investing is most important aspect of Personal Finance. This is the cushion which you will create for your future. Saving money in your prime for the future goals or investing the money to make a steady stream of income for your old age is the basis of this stage.

Each person has some financial goals like buying house, buying own vehicle, funding child education, good retirement life etc. This is where your savings and investments will help you. Life is full of uncertainties and your savings will help you reduce the risks arising through those uncertainties.

Saving for your house or child education, investing in the health & life insurance or investing in stocks, mutual funds, fixed deposits surely help you achieve your goals or live peaceful retirement life.

We will discuss the different approaches and available avenues for Saving and Investing in future blogs.

Also read : How to Save Money: A Comprehensive Guide

Also read : The Ultimate Guide to Investing for Beginners: Tips, Strategies, and Best Practices

Recommended reading

If you are interested in books, there are many good books you can read to improve your knowledge on Personal Finance. One book on Personal Finance that I would recommend to everyone is –

“Rich Dad Poor Dad” by Robert T. Kiyosaki

I think the book is so popular because it is written in very simple, layman language which anyone can understand and connect to.

The author tells you the story of a boy who is growing up with two fathers – his friend’s father and his father, one rich, one poor.

It takes you on a journey of Personal finances from wealth creation to acquiring assets to managing risks etc.

Here is the guide to best Personal Finance Books for Beginners. Do check it out.

Also read : Best Personal Finance Books for Beginners

Final thoughts !!

Whether you are a student or a young adult or a person getting retired, personal finance planning is very important for each and every one. Unless you follow the basic rules of Personal Finance you will not be able to successful in life. This is the very reason you should give sufficient importance to your Personal Finance Management.

FAQ

How do I get started in personal finance?

First thing you need to do is to understand the basic pillars of Personal finance – Income, Budget and Save & Invest. Once you understand the how these 3 impact your finances and its importance, you are on your way to mange your finances

How do you keep up with personal finances?

Having a monthly budget and sticking to it will help keeping up with your personal finances. You may not be 100% following the budget you created but more closer you are to your budget, more effective your finances will be.

What are the steps in the process of personal financial planning?

As explained in above article, there are three steps for personal financial planning – 1. Maximize your Income, 2. Plan/Budget your expenses and 3. Save & Invest

How do you determine your personal financial goals?

Personal Financial Goals are specific to each individual. Like one person might have goal of buying a house while other may have goal of travelling across the world. But of course, there are few goals which are common to almost all the people – good savings/investments to have a steady income in retirement, health & life insurance, term insurance for family members etc.

4 thoughts on “Personal Finance For Beginners”